Award-winning PDF software

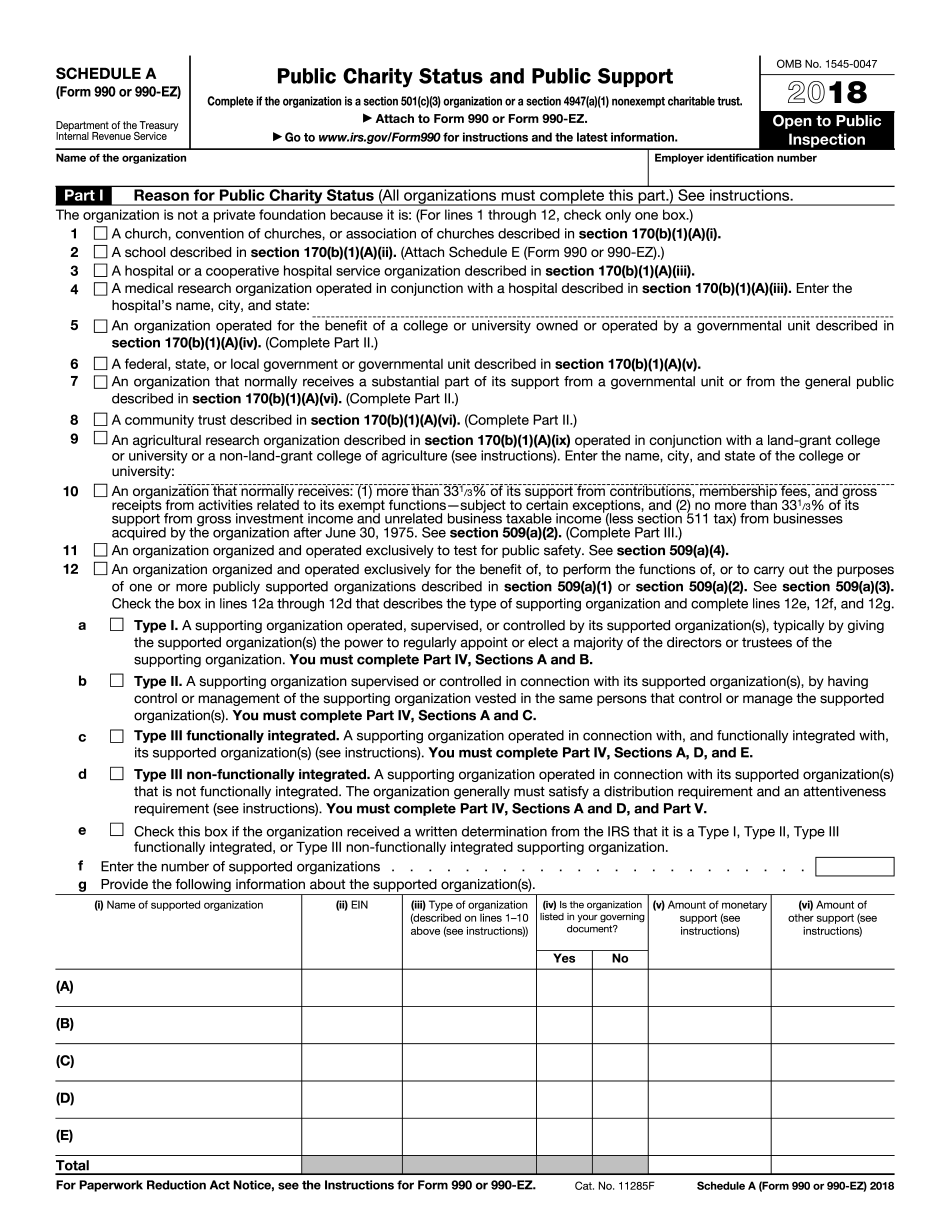

Printable IRS 990 - Schedule A 2024 Form El Monte California: What You Should Know

A Nonprofit organization established to promote education, the arts, culture and the arts. Organization: El Monte Music Foundation Filing Status(s): Nonprofit organization and other entity Type: Foreign Nonprofit Organization Type: Foreign Nonprofit Organization Type: Foreign Nonprofit Organization Type: Foreign Nonprofit Organization Type: Foreign Nonprofit Organization Type: Foreign Nonprofit Organization Type: Foreign Private Foundation Filing Status(s): 501(c)(3) organization and other entity Type: Foreign Publicly Supported Type: Foreign Private Foundation Total Income Tax Filings: Tax years 2020, 2019, 2018 Amount of Tax Deductions: — Total amount of individual and corporate and real estate tax deductions for the year. Amount of Tax. Deductions: — Total amount of individual and corporate and real estate tax deductions (all the actual deductions) for the year. Total amount of Property Tax Deductions. Tax Year: 2020. Real Estate and Other Property and Equipment Tax Deductions and Credits, and Net Operating Loss Carryovers: For Nonprofit Organizations. For Nonprofit Organizations Total Amount of Personal Exemption (FICA) and Employer Provided Employee Payroll Expense Exemptions: For Nonprofit Organizations. For Nonprofit Organizations Amount of Business Exemption (Franchise Tax Credits). Tax Year: 2018. Gross Amount of Sales of Merchandise Sales. Tax Year: 2018. Total Earnings Excluded From Income. Tax Year: 2018. Losses From Operations. Tax Year: 2018. Sales and Use Tax Return. Tax Year: 2018. Amount of Taxes Due. Tax Year : 2022. Number of Forms Filed. Tax Year: 2022. Form 990A, Return of Organization Exempt From Income Tax Form 990A is a report that organizations file with the IRS. There may be a number issued. Form 990A, Return of Organization Exempt From Income Tax Filing Status: Tax Year: 2020. Form 990, Return of Organization Exempt From Income Tax Form 990, Return of Organization Exempt From Income Tax A Nonprofit organization established to promote education, the arts, culture and the arts. Tax Year: 2020.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable IRS 990 - Schedule A 2024 Form El Monte California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable IRS 990 - Schedule A 2024 Form El Monte California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable IRS 990 - Schedule A 2024 Form El Monte California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable IRS 990 - Schedule A 2024 Form El Monte California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.