Award-winning PDF software

Phoenix Arizona online IRS 990 - Schedule A 2024 Form: What You Should Know

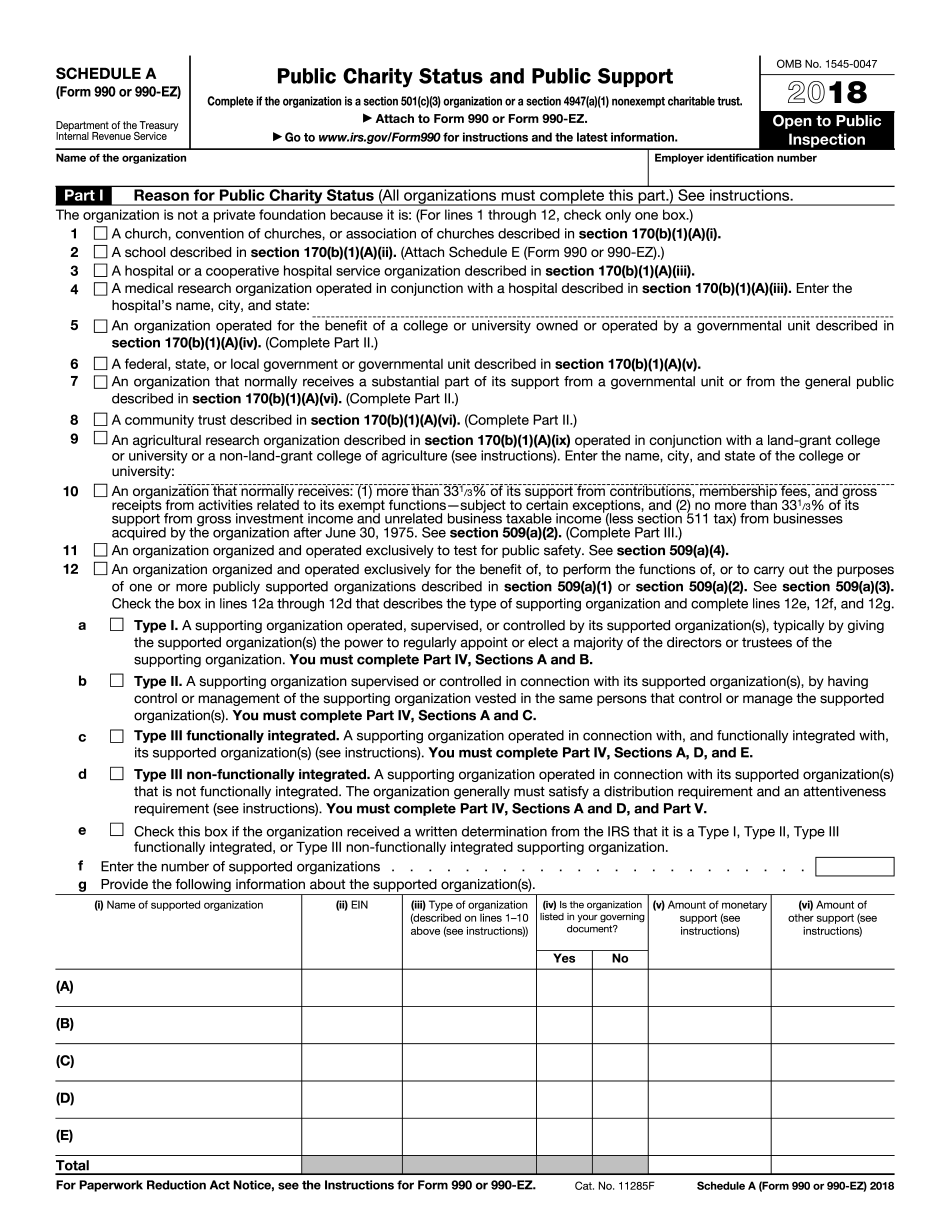

Form 990-PF, Form 990, Form 991, and Form 945 for reporting the organization's gross receipts have to be completed and filed. No additional forms are required. But not all states, as California does, have similar requirements. Some states, including New Jersey, require organizations to file a tax return to the state level. Some states require tax filers to file a separate tax return for each state to which it has an annual reporting requirement. California's “Form 990 California” is a summary-of-its-total-income form that provides the amount of any income that will be taxed through the California income tax; but California state law also exempts some groups from state income tax and lets them pay that tax instead of income tax. California State Government's Revenue and Tax Department estimates that about 80.7 million in state funds are available to support some activities that qualify as a “charitable, educational and cultural organization.” It would be helpful if we were to learn “California's” definition, if only to provide a “framework” that California must abide by to prevent organizations from being singled out for tax exemption through a separate “Statewide organization fee” and/or state tax return filing requirements. The definition and purpose of a tax-exempt organization and its relationship to California state law can be clarified by understanding how California treats entities that qualify for a tax exemption. The IRS defines a charitable organization as a nonprofit organization that: pursues the welfare of individuals and families by providing in-kind contributions to a local or national cause or causes of civic concern that serve the public generally; The IRS also defines as a charitable organization a person(s) who is an individual who has done any of the following: (a) Willfully performed services for nonprofit purposes or for the benefit of a nonprofit organization; or (b) Willfully made an unreasonably large personal contribution. The IRS definition of the term “person” includes partnerships, companies, societies, trusts or estates. To qualify for tax-exempt status, California must follow the IRS guidelines for charitable organizations. The State Board of Equalization (SHOE) regulates the activities of all registered charities.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Phoenix Arizona online IRS 990 - Schedule A 2024 Form, keep away from glitches and furnish it inside a timely method:

How to complete a Phoenix Arizona online IRS 990 - Schedule A 2024 Form?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Phoenix Arizona online IRS 990 - Schedule A 2024 Form aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Phoenix Arizona online IRS 990 - Schedule A 2024 Form from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.